ADVERTISEMENTS:

After reading this article you will learn about the format of preparing cash book.

A Cash Book is a type of subsidiary book where cash (or) bank receipts and cash (or) bank payments made during a period are recorded in a chronological order. Receipts are recorded on the debit - the left hand side, and payments are recorded on the credit - right hand side.

A day book-cum-ledger kept for making entry of the cash transactions as well as posting to the cash and bank accounts is called Cash Book. It is a unique book of account that combines journal and ledger. Cash Book is a journal for making primary entry of all cash transactions.

Read 707 reviews from the world's largest community for readers. He was the Man in Black, a country music legend, and the quintessential Ame. Single column cash book Format. Date: The date column of the cash book is used to record the year, month and actual date of each cash. Balancing a single column cash book. The single column cash book has only one money column which is totaled and balanced.

It is also ledger wherein cash and bank accounts are maintained. More interestingly, in the Cash Book primary entry is passed and posting is made only in one stroke. Since it is journal, posting is necessary for the corresponding debit or credit account. Since it is ledger of cash and bank accounts, no posting for cash and bank accounts is necessary. Like other ledger accounts Cash Book is balanced at a regular interval (say daily or weekly).

Various Types of Cash Book:

ADVERTISEMENTS:

Single Column Cash Book: Pixelmator pro 1 3 13.

In this Cash Book entry and posting are made for purely cash transactions. It has only one amount column in each of the debit and credit sides.

See the design of Single Column Cash Book. It is just like any other ledger account in the T-form.

Digital diary. ADVERTISEMENTS:

In both the debit and credit sides, it has five columns:

(i) Date,

(ii) Particulars,

(iii) Voucher No.,

ADVERTISEMENTS:

(iv) Ledger Folio, and

(v) Amount.

In any other ledger account, there is no Voucher No. column, instead there is Journal Folio column. This is so in the Cash Book because it is also a Journal. Reference must be given here about the evidence of occurrence of the transactions. Amount column gives debit or credit amount as per the nature of the transaction.

Double Column Cash Book:

In this Cash Book entry and posting are made for cash and bank transactions. The design of this Cash Book is like the single column Cash Book except that it has two amount columns on both the debit and credit sides.

Triple Column Cash Book:

In this Cash Book three amount columns are maintained on both the debit and credit sides—the first column is for discount, the second for cash and the third for bank.

Single Column Cash Book:

This format of Cash Book is useful when either there is no bank transaction or bank transactions do not occur frequently. Bank account is opened separately for bank transactions, if any.

Example 1:

Given below are the cash transactions of M/s. Mehta Bros, for the first week of January, 2009:

Jan 1. Mehta invested Rs.5,50,000 in business.

Jan 2. Paid for furniture Rs.1,50,000.

Jan 3. Purchased goods Rs.3,75,000.

Jan 4. Sold goods Rs.2,75,000.

Jan 5. Paid to M/s. Jamuna Das Rs.1,25,000 for credit purchase.

Jan 6. Collected Rs.1,75,000 from M/s. Iswarlal Bros, for credit sales.

Jan 6. Inear display – cruelle 1 1 osx retail download free. Paid for postage Rs.110.

Jan 6. Paid for stationery Rs.575.

Jan 6. Paid for wages Rs.2,000.

Jan 7. Paid Rs.7,500 for electrical fittings.

Jan 7. Paid Rs.10,000 for installation of telephone.

Jan 7. Deposited into bank Rs.50,000.

Prepare Single Column Cash Book.

Solution:

Entries and Postings in Single Column Cash Book

(1) Make the transaction analysis to identify debit and credit accounts.

For a cash transaction one of the accounts must be cash account.

(2) Cash balance is increased by cash receipts. Cash receipts are also called cash inflows. For every cash receipt cash account is debited since it increases cash balance which is an asset. For every cash payment cash account is credited since it decreases cash balance. Cash payments arc also called cash outflows. For all cash receipts postings are made on the debit side of Cash Book using prefix ‘To'. For example, for the transaction dated Jan. 1 of illustration 5.9:

Cash A/c Dr.

To Capital A/c

which is posted on the debit side as To Capital A/c'.

Similarly, for all payments, postings are made on the credit side using prefix ‘By' with the corresponding debit account. Take the example of payment made for installation of Telephone Fittings on 7th Jan. from Illustration 5.9:

Telephone Deposit A/c Dr.

To Cash A/c

which is posted as ‘By Telephone Deposit A/c'

Likewise ledger postings in the Cash Book too postings are made in the ‘Particulars Columns.' But likewise in journal entries a narration is added.

(3) For posting on the debit side, i.e. for cash receipts, date of transaction is mentioned in the ‘Date Column' on the debit side. For credit posting date of transaction is mentioned in the ‘Date column' on the credit side.

(4) For debit posting reference No. of the evidence of transaction is recorded of the ‘Voucher No.' column in the debit side and for credit posting that of the credit side.

(5) For debit posting ledger folio Nos. of the corresponding credit accounts are given in the ‘L.F. Column' of the debit side and for credit posting ledger folio Nos. of the corresponding debit accounts are given in the ‘L.F. Column' of the credit side.

(6) Amount of the transactions are posted in the ‘Amount Column' of the debit side for cash receipts, i.e., debit postings and of the credit side for cash payments, i.e., credit postings.

(7) Single Column Cash Book will have always debit balance. It is not possible to spend cash without having cash in hand.

Double Column Cash Book:

In this format of Cash Book, cash and bank transactions are recorded and thus it gives ledger of both the cash and bank accounts. Now-a-days volume of bank transactions of even a small business are so high that Single Column Cash Book is not so useful. A business enterprise pays through cheques and collects money from its customers through cheques. Even a small business enterprise maintains current account with a bank through which it pays and receives.

Entries and Postings in Double Column Cash Book:

(i) All payments by cheque decrease bank balance so these are posted on the credit side and amounts are posted in the bank column. But payments by cash are posted on the credit side with amounts in the cash column.

(ii) All receipts in cash are posted on the debit side with amounts in the cash column. But posting of the receipts by cheque needs little clarification.

If cheques are received and immediately sent to bank for collection, it should be treated as bank transaction and so the amount should be posted on the debit of bank column. However, if cheques are received but endorsed in favour of other, then it should be posted on the debit of cash column on receipt and on the credit of cash column on endorsement.

(iii) When cash is deposited into bank and when cash is withdrawn from bank, both cash and bank accounts come into operation simultaneously. For cash deposit journal entry is:

This means simultaneous debit posting in the bank column but credit posting in the cash column which implies decrease in cash balance but increase in bank balance.

To the contrary, for cash withdrawals journal entry is

This means debit posting in the cash column and credit posting in the bank column. These are called Contra Entry or Contra Posting. Contra means simultaneous debit and credit posting. For Contra ‘C' mark is put in the Ledger Folio Column.

(iv) Sometimes cheques deposited into bank are dishonoured for many reasons.

Most frequent of such reasons are:

(a) Wrong entry in the cheque, and

(b) Inability of the drawer to make payment.

In any case on receipt of the cheque the following entries are passed:

If the cheque becomes dishonoured, in the first case, the reverse entry is to be passed:

In the second case, the reverse entry would be like this:

(v) Bank charges a small amount for services done by it on behalf of the clients. Necessary entry is:

Also Bank sometimes pays small interest on savings account balance. Necessary entry is:

(vi) Cash column always shows debit balance:

This means cash payments must be less than cash receipts. Incidentally, there may be zero balance in the cash column but bank column may show either debit or credit balance. This means bank receipts may be less than bank payments. This is possible under overdraft arrangement with bank by which bank allows its customers to withdraw up to a certain limit above the deposit.

Example 2:

Ms. Madhumita gives the following information about her cash and bank transactions as on 17th January, 2009:

Balance in hand – Cash Rs.700. Bank Rs.1,47,500.

Paid Carriage Rs.250.

Paid to Ms. Lalita, a supplier. Rs.87,500 by cheque.

Collected Rs.67,500 by cheque from Mr. Ashok and deposited the same into bank.

Collected another cheque of Rs.12,500 from Ms. Razia and kept it for endorsement.

Got information that a cheque of Rs.27,500 collected from Mr. Abhadoot has been dishonoured.

Withdrew cash for office use Rs.15,000 and for personal use Rs.3,000.

Prepare a Double Column Cash Book. https://bestvload593.weebly.com/anna-1-1-a-first-person-horror-adventure-game.html.

Solution:

Use these cash book format instructions to make your very own cashbook spreadsheet using plain paper or a school exercise book.

This is ideal if you don't want to use a computer to keep your cash book and are happy to do it the good old-fashioned manual way.

This is great for not for profit clubs and groups, or small side biz activities such as craft fairs or lemonade stands.

Simple Bookkeeping

Maintaining a cash book is the only method for simple bookkeeping.

Therefore, the aim of this lesson is to show you how to design and format a simple cash book, or in other words a simple bookkeeping spreadsheet.

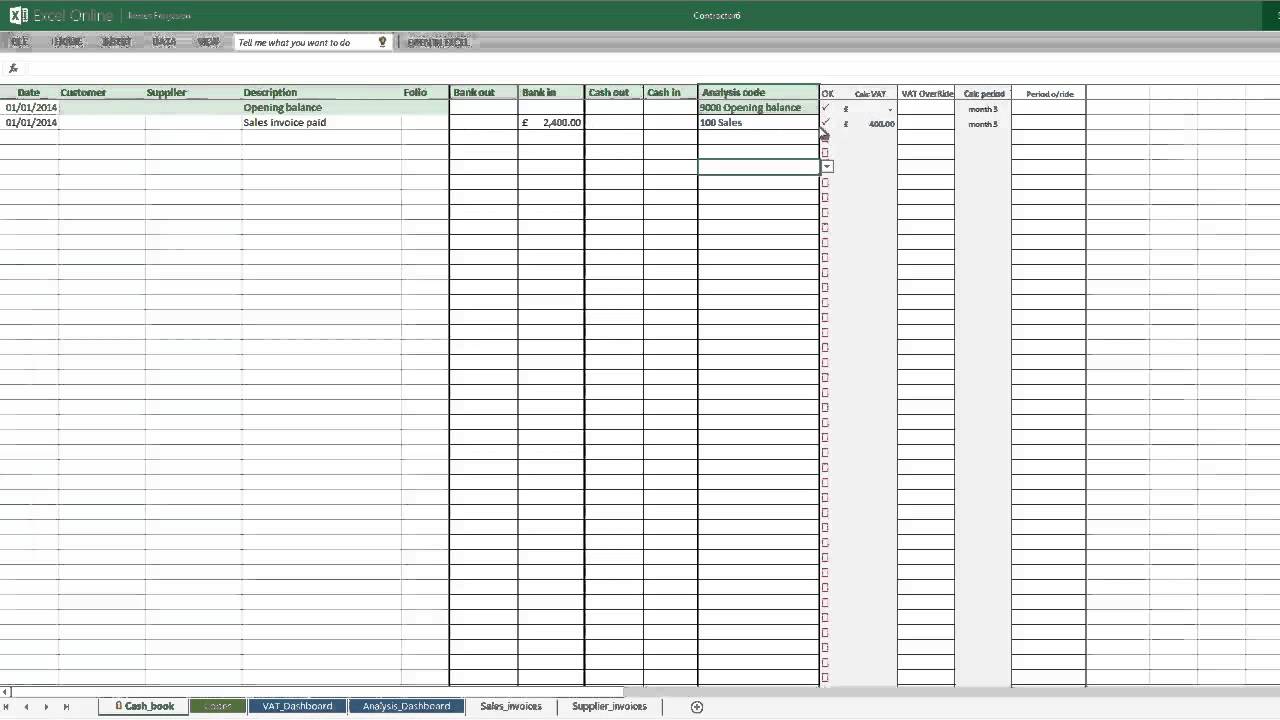

If you want one in excel – check out our free excel cash book template.

If not, continue reading on.

What is a Cash Book?

All money paid into or out of a bank account or cash box needs to bereplicated within the bookkeeping system – the book to do this in is the CashBook because it is the record of what happens with the money received or spent.

In this case, cash is a lose term covering not only papermoney and coins but also cheques/checks, direct credits, electronic transferpayments, and so on.

All computerized bookkeeping programs use a cash book but youmight not see the words Cash Book, you might just see something like BankEntries, or Spend and Receive Money or Transactions.

Let's get started with the cash book format.

For a very basic cash book spreadsheet, to help you do manual bookkeeping, you need to take a blank sheet of printer paper and do the following using a ruler and pen or pencil (there are picture graphics below):

- place the page in front of you either in portrait view or in landscape view – either is fine

- draw a border around the page

- draw five columns – see our example below for an idea of column sizes

- draw one row at the top of the page for entering the heading names of each column

- fill up the remainder of the page with rows for writing in daily cash book entries

Your headings will be:-

- Date

- Details (or Description)

- Money In (or Income)

- Money Out (or Expenses)

- Balance

Cash Book Format Sample

Here is cash book format sample (click to enlarge). My measurements are listed here too.

Paper Size

I used an A4 size printer paper.

I gave it a 1cm border all round.

Column Widths

The Details column is 9cm wide.

The other columns are 2.5cm wide – the cash book format looks more balanced if they are the same size.

You may want to make the left margin (border) bigger and the description column smaller if you know you are going to hole punch the paper on the left and file it away. You don't want the holes to cut out any information in the date column.

Row Height

The rows are 1cm in height but you can make them a bit narrower if you prefer. The top row used for the headings is 1.6cm

And that's all there is to it!

a school exercise book or lined paper

You could just buy a school exercise book which already has rows printed in it, so all you have to do is draw in the columns.

Exact measurements are not a requirement for keeping a cash book spreadsheet. You just need space to write a description and the money values.

Pre-Printed Cash Books

If that all sounds like too much hard work just go and buy acash book, already formatted and printed, from a stationery store or offAmazon.

Cash Book Entries Example

Here is the same sample above that now has some random information entered into it with my quick (but messy!) handwriting. Steermouse powerful third party mouse driver 5 4 3. This is to show you how easy it is to keep a spread sheet to track the money.

The numbers in brackets mean the bank account has gone in to overdraft. This would not occur if you are just dealing with cash at fairs, unless some cash has gone missing.

Click to enlarge.

How to Fix Errors

The above example shows a few deliberate hand-written errors and what you can do to fix them – you can cross them out neatly and write above them, or *use white paper tape and write over them.

How Many Transactions Per Page

You can use one page a month, or if the entries are very few for each month, you can do two or three months on one page.

You just need to show a Closing Balance for the previous month, and an Opening Balance for the new month – this example shows what that looks like.

*Back in the day when everyone was doing manual bookkeeping, whiting out errors and writing over them was a big no-no.

Cash Bookkeeping

This was to prevent the books being 'cooked' by fraudulent bookkeepers.

For those of you who don't know what 'cooked' means, it means the cashbook was adjusted for crooked, personal gain or just outright theft.

Whiting out errors and writing over them makes it very difficult for anyone to be 100% sure that you have processed the accounts in good order (such as auditors). This is also why it is important to have receipts, invoices and other source documents which prove the transactions are correct.

Simple Profit and Loss Report

Here is what a simple profit and loss report would look like based on these cash book entries. Click to enlarge.

This shows the business making a net loss (Funds introduced and Drawings do not go on the profit and loss report but on the balance sheet – learn more about that here)

Cash Book Excel Template

Detailed Cash Book

For a more detailed cash book, format it with extra columns – check out the information on this in single entry bookkeeping.

Cash Book Example

If you have any questions on this cash book Format you can write them on the Facebook comments below, or use the Contact form.

Home > Single Entry Bookkeeping > Cash Book Format

Cash Book Format

Facebook Comments

Cash Book Example

Have your say about what you just read!Leave me a comment in the box below.